FINANCIAL HIGHLIGHTS- SBI Q4 RESULT

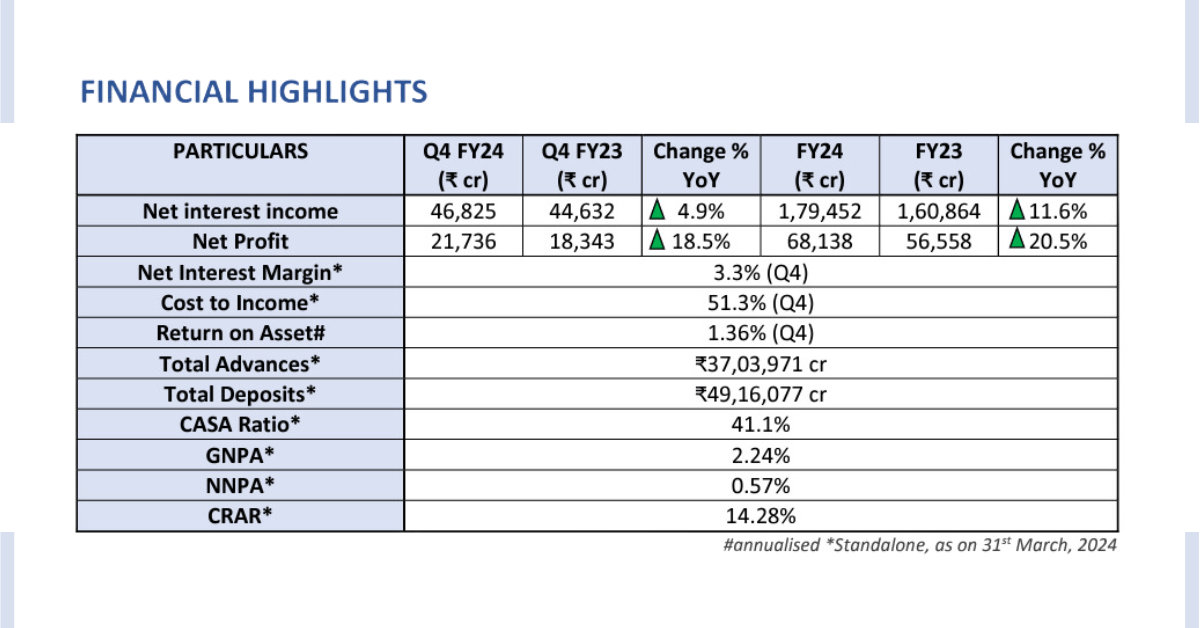

- SBI Q4 result posted modest net interest income (NII) growth of 3.1% Year over Year, mainly due to a drop in margin.

- The net interest margin (NIM) was up 8 bps sequentially, while on a year-over-year basis, it was down 30 bps to 3.3% for Q4 FY24.

- SBI’s non-interest income surged impressively, marking a 24.4% YoY and 51.6% QoQ increase. This growth was driven by a 9.01% YoY rise in fee income and a staggering 92.4% YoY increase in treasury income, showcasing the bank’s successful diversification of revenue sources.

- Operating expenses declined 2.1% QoQ and was up 1.8% YoY. The cost-to-income ratio stood at 51.3%, down by 341 bps YoY.

- SBI’s provisions significantly decreased by 51.4% YoY and 79.3% QoQ. This reduction was partly attributed to the release of some provisions, reflecting the bank’s improved asset quality and effective risk management.

- Net profit (standalone) was up 24% Year over Year to ₹20,698 crore, driven by low opex and credit costs.

SBI Q4 RESULT- LOANS AND DEPOSITS

• In Q4 FY24, the bank’s net credit growth was 15.8% YoY and 5.2% sequentially, and the total loan book stood at ₹37.03 lakh crore.

• Retail loans jumped 14.7% YoY, with the home and auto loan segments showing 13.3% YoY and 19.5% YoY, respectively, while the personal loan segment saw a healthy growth of 14.6% YoY.

• Agriculture portfolio increased by 17.9% YoY to ₹3.04 lakh crore, while SME book reported a 20.5% YoY growth to ₹4.33 lakh crore.

• The corporate loan portfolio has continued gaining traction, increasing by 16.2% YoY to ₹11.4 lakh crore. The international book was up by 9.5% YoY.

• Deposit growth for the quarter was 11.1% YoY and 3.2% QoQ, and total deposits stood at ₹49.2 lakh crore.

• Domestic CASA deposits increased by 4.2% YoY, forming 41.1% of total domestic deposits.

• The bank has ₹3.7 lakh crore worth excess SLR on its balance sheet.

SBI Q4 RESULT- ASSET QUALITY AND CAPITAL ADEQUACY

• In Q4 FY24, the overall asset quality for SBI improved as GNPA and NNPA ratios declined by 18 bps and 7 bps to 2.24% and 0.57%, respectively.

• Fresh slippages during the quarter stood at ₹3,984 crore versus ₹5,046 crore QoQ and ₹3,458 YoY; thus slippage ratio stood at 0.62% versus 0.65% YoY.

• Recoveries & upgrades for the quarter stood at ₹2,052 crore versus ₹1,798 crore sequentially.

• The bank’s SMA 1 & 2 (Special Mention Accounts) stood at ₹3,301 crore, as against ₹4,128 crore in the previous quarter.

• The Bank currently has restructured book worth ₹17,279 crore versus ₹24,302 crore QoQ and forms ~0.47% of net advances.

• SBI’s provision coverage ratio (PCR) stands at 75.02%, and the bank currently has non-NPA provisions worth ₹32,257 crore that are not included in PCR.

• Credit cost for the bank stood at 29 bps versus 32 bps YoY.

OTHER BUSINESS UPDATES

• The Bank has an attrition rate of 1.43% for FY24.

• SBI expects to absorb excess provisions due to the new draft project loans norm without much hassle.

• The bank has 7.4 crore on its YoNo Platform, up from 6.1 crore YoY, and SBI opened 88 lakh savings accounts via the YoNo platform.

FUTURE OUTLOOK

- SBI expects loan growth to be around the 13%-15% mark.

- SBI’s cost of funds has nearly peaked, and it doesn’t anticipate any significant rise shortly.

- Expectations indicate that NIMs will remain at current levels.

- There’s an anticipation of a decline in the cost-to-income ratio for SBI.

- The bank aims to have an ROE of over 15% on a sustainable basis.

FAQs:

- What are SBI’s key financial highlights for Q4 FY24?

Ans. SBI’s Q4 FY24 showcased a 3.1% YoY growth in net interest income and a remarkable surge in non-interest income by 24.4% YoY.

- How did SBI’s loan and deposit portfolios perform in Q4 FY24?

Ans. In Q4 FY24, SBI witnessed a 15.8% YoY growth in net credit, with the loan book standing at ₹37.03 lakh crore and an 11.1% YoY growth in deposits, totalling ₹49.2 lakh crore.

- What is the SBI’s asset quality and capital adequacy position in Q4 FY24?

Ans. SBI’s asset quality improved with a decline in GNPA and NNPA ratios, fresh slippages, a restructuring book, a PCR of 75.02%, and a credit cost of 29 bps.

- What are some other business updates from SBI in Q4 FY24?

Ans. SBI reported an attrition rate of 1.43% for FY24, expects to absorb excess provisions due to the new draft project loans norm, and witnessed growth in its YoNo platform users.

- What is SBI’s future outlook post Q4 FY24 results?

Ans. SBI anticipates loan growth of around 13%- 15%, stable NIMs, and a declining cost-to-income ratio. It also aims for a sustainable ROE of over 15%.