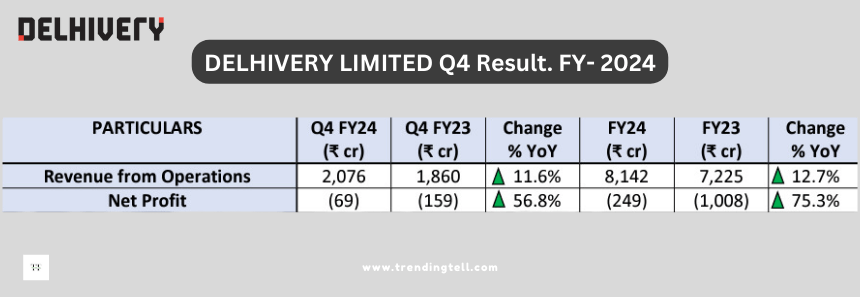

Revenue: ₹2,075.5 cr (▲11.6%) Net Profit: ₹-68.5 cr (▲56.8%)

DELHIVERY LIMITED Q4 Result: FINANCIAL HIGHLIGHTS

• The company witnessed significant improvement in profitability during FY24. The EBITDA registered in FY24 was ₹127 crore compared to a negative ₹452 crore in FY23.

• The corporate overheads have remained broadly range-bound in comparison to FY23.

• The adjusted EBITDA for FY24 stood at ₹76 crore.

• Net working capital days reduced on a YoY basis from 38 to 31 days for FY24.

• The marketing expenses increased from ₹22 crore in FY23 to ₹35 crore in FY24.

• The capex for FY24 stands at ₹600 crore.

DELHIVERY LIMITED Q4 Result: BUSINESS HIGHLIGHTS

• The express parcel business continues to grow robust in key segments. It has achieved an overall service EBITDA of 18% for FY24.

• The express parcel shipments grew 11% to 74 crore in FY24 from 66.3 crore in FY23. Revenue from this increased by 12% to ₹5,077 crore in FY24 from ₹4,552 crore in FY23. Quarterly, express parcel shipment volume was 176 million, and revenue was ₹1,217 crore in Q4 FY24, a growth of 3% from ₹1,177 crore in Q4 FY23.

• The part truck load (PTL) business has grown 30% year-over-year to 1,429K tons in FY24 from 1,101 K tons in FY23, with significant profitability and market share improvements. Correspondingly, revenue from PTL service grew 31% to ₹1,517 crore in FY24 from ₹1,157 crore in FY23. They will try to maintain this growth in the future.

• On a quarterly basis, PTL freight volume grew 21% to 384K tons in Q4 FY24 from 318K tons in Q4 FY23. Revenue from PTL service rose 27% to ₹417 crore in Q4 FY24 from ₹328 crore in Q4 FY23.

• The supply chain services (SCS) business has remained broadly flat in revenue terms on a YoY basis. The revenue was ₹234 crore in Q4 FY24 v/s ₹188 crore in Q4 FY23. On a full-year basis, revenue was ₹776 crore.

• The supply chain service business has doubled service EBITDA between FY23-FY24 by commercial renegotiation and operational optimization.

• The truckload business has grown 40% YoY with improved service EBITDA profitability. Truckload service revenue was ₹174 crore in Q4 FY24 v/s ₹109 crore in Q4 FY23. On a full-year basis, revenue from truckload service was ₹609 crore and cross-border services at ₹153 crore. • The express business continued to be the largest part of the business and was at 62% of revenue.

• It continues to invest in network expansion and capacity. The network expansion now covers 18,793 pin codes across India.

DELHIVERY LIMITED Q4 Result: UPDATES

• As of 31st March 2024, they had 33,278 active customers.

• They had 111 gateways, 29 automated sort centres, 4,400 express delivery centres, and 129 freight service centres as of 31st March 2024.

• Their infrastructure space improved to 18.82 million square feet in Q4 FY24 v/s 17.99 million square feet in Q4 FY23

• During the quarter, the company’s market share remains stable in the overall parcels shipped. LIMITED

• The volumes have increased in Q1 FY25, and capacity utilization has also increased.

FUTURE OUTLOOK

• The management envisages growth of 15% % to 20% going forward, primarily driven by the rise in the e-commerce segment.

• The express business margin is envisaged to be in the range of 18%-20%.

• The capex for FY25 is expected to be 6.6%-6.9% of revenue. The vehicle capex will remain in range, i.e., the company will not deviate from their historical capex. However, capex will come down on infrastructure.

• They anticipate growth in SCS business, improvement in profitability and service EBITDA for FY25.

Disclaimer: This document summarises a conference call for learning purposes only and does not constitute a recommendation on any stocks or sectors.

Frequently Asked Questions (FAQs)

- What were Delhivery Limited’s financial highlights for FY24?

- Revenue from operations in FY24 was ₹8,142 crore, with a YoY growth of 12.7%.

- Net profit for FY24 was ₹-249 crore, showing a significant improvement of 75.3% compared to FY23.

- How did Delhivery Limited’s express parcel business perform in FY24?

- The express parcel business experienced growth in shipment volume, with an 11% increase to 74 crore shipments in FY24.

- Revenue from the express parcel business also grew by 12% to ₹5,077 crore in FY24.

- What was the growth and performance of Delhivery Limited’s part truck load (PTL) business in FY24?

- The PTL business grew 30% year over year, and freight volume increased 21% to 384K tons in Q4 FY24.

- Revenue from PTL service grew by 27% to ₹417 crore in Q4 FY24.

- How did Delhivery Limited’s supply chain services (SCS) business perform in FY24?

- The SCS business remained broadly flat in revenue terms on a YoY basis, with revenue of ₹234 crore in Q4 FY24 and ₹776 crore on a full-year basis.

- The SCS business doubled its service EBITDA between FY23 and FY24 through commercial renegotiation and operational optimization.

- What are Delhivery Limited’s future outlook and growth projections?

- Management envisions a future growth rate of approximately 15%- 20%, primarily driven by the rise in the e-commerce segment.

- The express business margin is expected to be in the range of 18%-20%.

- The CAPEX for FY25 is projected to be 6.6%- 6.9% of revenue, focusing on historical vehicle capex and a reduction in infrastructure capex.

- The company anticipates growth in the SCS business, along with improved profitability and service EBITDA for FY25.