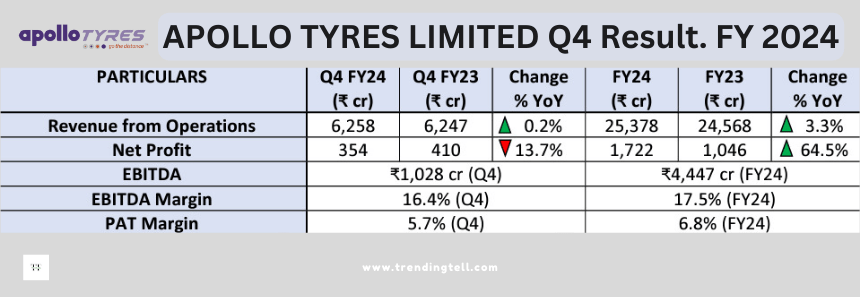

- Revenue: ₹6,258.2 cr (▲0.2%) Net Profit: ₹354.1 cr (▼13.7%)

APOLLO TYRES LIMITED Q4 Result: FINANCIAL HIGHLIGHTS

• The company’s EBITDA margin for Q4 FY24 was 16.4%, including the impact of EPR (extended producer responsibility) liability to the extent of ₹68.5 crore.

• The return on capital employed stood at 16% on 31st March 2024 compared to its targeted range of 12%-15%. The net debt to EBITDA was reported at 0.6x during the same period.

• Over the years, the company has reduced its debt by ₹1,800 crore. • Other income was higher for the quarter on a YoY basis owing to forex gain to the tune of ₹40 crore.

• The raw material price basket was flattish between Q3 and Q4 FY24, respectively. Natural rubber price was at ₹163/kg, synthetic rubber ₹155/kg and carbon black at ₹120/kg in Q4 FY24.

APOLLO TYRES LIMITED Q4 Result: BUSINESS HIGHLIGHTS

INDIA

• The revenue from this region in Q4 FY24 was ₹4,387 crore, registering a moderate growth of ~0.5% YoY and more than ~1% on a QoQ basis. EBITDA for the quarter was ₹680 crore with a margin of 15.6% v/s 15.9% in Q4 FY23. Excluding the impact of EPR, the margins would have been 17.2%.

• The company plans to offset the impact of EPR liability by implementing price increases, which were announced in May at ~3%. This price adjustment effectively counters the EPR costs and partially mitigates the impact of raw material price hikes.

• It anticipates mid-single-digit rise in raw material prices (~4%-5%) in Q1 FY25 and intends to counter this by implementing price increases (2%-2.5%) accordingly.

• In Q4 FY24, the company achieved overall volume growth of 4%, with the truck bus radial (TBR) replacement and passenger car radial (PCR) segments showing consistent growth rates of 7% and 10%, respectively. The replacement segment also demonstrated strong growth throughout FY24.

• < UNK> The TBR replacement category company’s market share is ~40%.

• The OEM (original equipment manufacturer) segment experienced a volume decline of 10%. In comparison, exports showed a significant volume increase of over 30%, backed by a rise in demand from the MEA (Middle East & Africa) region, the Americas, etc.

• Exports showed encouraging signs of pick-up.

• It registered double-digit growth towards the passenger vehicle & commercial car tyre segment in April 2024. The demand in the agri segment also seems to be coming back.

• The company foresees an uptick in demand in India following the elections, with an anticipated high single-digit growth in commercial vehicle segment tyres and double-digit expansion in PCR categories, driven by infrastructure development.

• The net to EBITDA for Indian operations stood at 0.7x as of 31st March 2024, showcasing a debt reduction of ₹1,100 crore for the year.

• The company is experiencing strong acceptance of the Vredestein brand in India, a margin-accretive segment.

EUROPE

• The revenue from this region was €182 million v/s €177 million in Q4 FY23, which was an increase of 3.1% YoY. Despite a challenging demand environment, the company successfully increased its market share across critical product segments.

• The revenue from Reifencom for the quarter was €35 million, and it was breakeven at EBITDA for Q4 FY24. For the year, it grew moderately and posted revenue of €200 million with an EBITDA margin of 4%.

• Maintaining its focus on premiumization, the company’s ultra-high performance (UHP) mix for the quarter reached 47%, up from 43% in the same quarter last year.

• EBITDA for the quarter was €35 million with an EBITDA margin of 19.1% v/s 18.1% in Q4 FY23. This expansion can be attributed to a better product mix from the UHP segment.

• The company aims to maintain a consistent EBITDA margin of ~16%-17% and expects it to rise to ~18%-19% under favourable demand conditions.

• Markets herein demonstrated double-digit volume growth in April 2024. • The company anticipates this region’s demand momentum to improve in FY25 v/s FY24. The operating performance is anticipated to stay robust, driven by the company’s persistent emphasis on enhancing the sales mix and optimizing costs.

• Owing to the raw material scenario, it shall consider taking price increases (~1%-2%) in Europe.

APOLLO TYRES LIMITED Q4 Result: UPDATES

• The company shall continue to be informed about capex and focus on profitable and sustainable growth.

• The cash outflow for capital expenditures was notably lower than expected, at ₹700 crore compared to the projected ₹1,100 crore. Looking ahead to FY25, the anticipated expenditure would be in the range of ₹1,000 crore.

• The company’s capex spending has been restrained due to lower-than-expected volumes. Currently, the PCR tyres capacity utilization stands at 80%. However, if demand continues as anticipated, there are plans to increase the PCR capacity in H2 FY25. This expansion would pave the way for meeting the demand forecasted for FY27, given that capacity for FY25 and FY26 is already sufficient.

• The company is leveraging productivity tools such as AI (artificial intelligence) and machine learning across all its PCR plants. It expects a 10%-15% increase in productivity from the existing equipment in these plants due to these technological enhancements.

• Management mentioned that they are in the process of acquiring the EPR certificate. Due to this compliance requirement, the manufacturer will not engage in recycling activities.

• It shall switch to a new tax regime once its MAT (minimum alternate tax) credits are exhausted.

• The company’s interest costs have not decreased despite a reduction in debt levels, primarily due to higher interest rates on borrowings for working capital (short-term borrowings). This trend is observed domestically and in Europe, where interest rates have risen as they are linked to benchmark rates.

Disclaimer: This document summarises a conference call for learning purposes only and does not constitute a recommendation on any stocks or sectors.

APOLLO TYRES LIMITED Q4 Result: Frequently Asked Questions (FAQs)

1. What was the revenue and net profit of Apollo Tyres Limited in FY24?

Answer: The revenue of Apollo Tyres Limited in FY24 was ₹25378 crore, and the net profit was ₹1,722 crore.

2. What was the EBITDA margin for Q4 FY24 and FY24?

Answer: The EBITDA margin for Q4 FY24 was 16.4%, and for FY24, it was 17.5%.

3. How much debt reduction did Apollo Tyres Limited achieve over the years?

Answer. Apollo Tyres Limited was able to reduce its debt by ₹1,800 crore.

4. What was the raw material price basket for Q4 FY24?

Answer: The raw material price basket for Q4 FY24 was as follows:

- Natural rubber price: ₹163/kg

- Synthetic rubber price: ₹155/kg

- Carbon black price: ₹120/kg

5. What was the European region’s revenue and EBITDA margin in Q4 FY24?

Answer: The European region’s revenue in Q4 FY24 was €182 million, and the EBITDA margin was 19.1%.