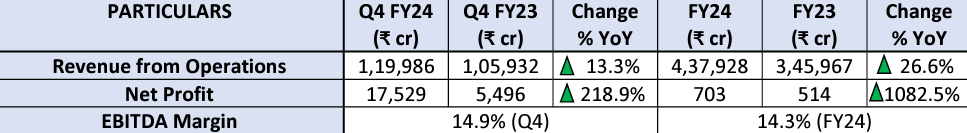

Tata Motors Q4 Result Revenue: ₹1,19,986.3 cr (▲13.3%) Net Profit: ₹17,528.6 cr (▲218.9%)

Tata Motors Q4 Result: Tata Motors has experienced a promising upward trajectory in revenue growth and profitability in FY24. The success can be attributed to strategic pricing actions, introducing new variants, and a richer product mix. The volumes for the company improved as the production of Jaguar Land Rover (JLR) ramped up, along with healthy demand from India. The net debt declined to ₹16,000 crore as of 31st March 2024, and Tata Motors has significantly reduced its net debt by approximately ₹27,700 crore. The company recommended a final dividend of ₹6 per share, which includes ₹3 of special dividend.

Tata Motors Q4 Result: FINANCIAL HIGHLIGHTS

- The volumes for the company improved as the JLR (Jaguar Land Rover) production ramped up along with healthy demand from India.

- Throughout FY24, Tata Motors has experienced a promising upward trajectory in revenue growth and profitability. This success can be attributed to our strategic pricing actions, introduction of new variants, and a richer product mix, which have significantly contributed to our higher revenue growth.

- Of the 13.3% growth in revenue in Q4 FY24, ~9% was achieved from volume & better product mix, ~0.2% via price increases, 3.4% on account of the currency translation (pound sterling vis-à-vis rupee) and the rest comprised others.

- The PBT (profit before tax, before exceptional items) was the highest ever, at ₹28,900 crore during the year, compared to ₹1,800 crore in FY23.

- The EBIT margin stood at 9.1% and expanded by ~230 bps YoY during the quarter. During FY24, it was higher by 470 bps to 8.3%.

- The finance costs were reduced by ₹239 crore to ₹9,986 crore in FY24 due to a reduction in gross debt.

- Investments in FY24 were ₹42,100 crore, up from ₹28,500 crore in FY23.

- The return on capital employed was 18.7% in FY24 v/s 6.5% in FY23.

- As of 31st March 2024, free cash flow stood at ₹26,900 crore v/s ₹6,400 crore as of Q3 FY24 and ₹7,800 crore in FY23 owing to significant cash profits and favourable working capital improvement.

- The net debt declined to ₹16,000 crore as of 31st March 2024. Of this debt, Tata Motors Limited (TML) India was net cash positive at ₹1,000 crore, JLR at ₹7,700 crore, and TML Holdings at ₹9,900 crore, respectively. The debt of JLR is envisaged to be settled entirely in the coming year.

- Over the past year, Tata Motors has significantly reduced its net debt by approximately ₹27,700 crore. This achievement underscores the company’s commitment to financial prudence and confidence in settling all outstanding debt soon.

- The company recommended a final dividend of ₹6 per share, which includes ₹3 of special dividend. The total cash outlay would be ₹2,310 crore.

Financial Summary: Tata Motors Q4 Result

Tata Motors has experienced a promising upward trajectory in revenue growth and profitability in FY24. The success can be attributed to strategic pricing actions, introducing new variants, and a richer product mix. The volumes for the company improved as the production of Jaguar Land Rover (JLR) ramped up, along with healthy demand from India. The net debt declined to ₹16,000 crore as of 31st March 2024, and Tata Motors has significantly reduced its net debt by approximately ₹27,700 crore. The company recommended a final dividend of ₹6 per share, which includes ₹3 of special dividend.

Tata Motors Q4 Result: BUSINESS HIGHLIGHTS

JAGUAR LAND ROVER (JLR)

- JLR delivered a strong performance in Q4 FY24, witnessing increased wholesale and retail sales. Revenue for the quarter was £ 7.9 billion, up 10.7% v/s Q4 FY23 and 6% v/s Q3 FY24. Revenue for the quarter was £7.9 billion, up 10.7% v/s Q4 FY23 and a rise of 6% v/s Q3 FY24. The annual revenue was £29 billion, up 27.1%.

- The performance was due to global demand for its luxury vehicles and operational improvement, led by Range Rover & Defender.

- Q4 FY24 PBT was £661 million, up £293 million YoY, because of increased volumes and reduced material costs, offset partially by increased marketing spend.

- The PBT was £2,165 million in FY24.

- The PAT for FY24 was £2.6 billion. This also includes recognition of DTA (deferred tax assets) of £1 billion due to a reassessment of future recoverability tax losses and allowances.

- EBIT margin was 9.2% in Q4 FY24, up by 270 bps YoY. The higher profitability reflects favourable volumes, improved pricing, and reduced material costs, offset partially by higher marketing expenses, selling costs, and forex. FY24 margins were higher by 610 bps to 8.5%.

- As of 31st March 2024, free cash flow was £2.3 billion, out of which £892 million was generated during Q4 FY24. Net debt stood at £0.7 billion. Liquidity was £5.7 billion, including an undrawn RCF (revolving credit facility) of £1.5 billion maturing in April 2026. Cash balance as of FY24 was £4.2 billion.

- At the end of FY24, the order book stood at 1,33,000 vehicles, 76% of which were for RR (Range Rover), RR Sport, and Defender.

- The company’s wholesales in Q4 FY24 were 1,10,200 units, up 16.4% Year over Year and 9% Quarter over Quarter. FY24 units increased by 25% to 4,01,300 units.

- Retails stood at 1,14,000 units, an increase of 11% Year over Year and 4% Quarter over Quarter. During the year, it stood at 4,32,000 units, up 22%.

- Range Rover/Range Rover Sport production continues to ramp up. The sale of Range Rover for Q4 FY24 was 58,300 units, and an increase of 22% YoY and 10.2% QoQ was observed.

- Defender sales stood at 28,700 units v/s 27,500 units in Q4 FY23 and 27,100 units in Q3 FY24, owing to supply-side constraints about engines, which are expected to bounce back.

- Jaguar posted sales of 13,500 units in Q4 FY24, an increase of 39% YoY and 11.6% QoQ. • The sales for Discovery stood at 9,700 units in Q4 FY24 v/s 9,600 units in Q4 FY23 and 8,900 units in Q3 FY24.

- Q4 FY24 wholesales were up in the UK, & North America compared to Q3 FY24, and 2024 wholesales were higher in all regions compared to the prior year. The UK recorded the best quarter, which was seasonally stronger for the area. At the same time, China de-grew on the back of the New Year holidays.

- Higher VME (variable marketing cost) led to an unfavourable impact on the margins; however, the material costs were favourable during the quarter.

- Working capital was favourable in the quarter as the company registered higher volumes.

- Total investment in FY24 was £3.3 billion. The engineering capitalisation rate was 62%, reflecting the expected maturation of vehicle programmes.

- The Range Rover Electric, Sport (Stealth), and Defender (Octa) will launch soon. The waiting list for the Range Rover model stood at 33,000 vehicles.

- JLR would pay Tata Motors dividends in the range of £400 million.

- The tax rate would be in the range of 25%-29%.

- The company shall ultimately be reducing its debt by FY25 and will continuously work towards reducing it.

- They will continue to focus on brand activation to maintain the order book.

- Tata Motors anticipates maintaining EBIT margins at FY24 levels in FY25. Looking ahead to FY26, the company aims to achieve EBIT margins of approximately 10%, reflecting its commitment to sustained growth and profitability.

- It anticipates a modest increase in investment spending to £3.5 billion but still expects to become net debt zero during FY25.

- Free cash flow would be breakeven in Q1 FY25. However, it would not be net positive due to working capital requirements.

COMMERCIAL VEHICLES (CV): Tata Motors Q4 Result:

- Revenue from this segment in Q4 FY24 stood at ₹21,590 crore, an increase of 1.6% YoY due to improved pricing and mix. FY24 revenue stood at ₹78,790 crore, higher by 11.3%. The demand-pull strategy continued to yield results as realisations and profitability improved.

- The quarter’s EBITDA margin was 12%, an expansion of 190 bps. Profit before tax (before exceptional items) was ₹1,984 crore, an addition of ₹280 crore YoY.

- The EBITDA margin and PBT in FY24 was 10.8% and ₹6,102 crore. They both expanded by 340 bps and ₹2,867 crore, respectively.

- In Q4 FY24, domestic wholesale CV volumes were 1,04,600 units, lower by 7% YoY because of increased pre-buy in Q4 FY23 due to the BS6 Phase II transition. Exports were at 4,500 units, increasing by 13% YoY.

- The overall CV market share continued to improve, with the truck market share remaining robust. Market share continues to be higher in HCV (heavy commercial vehicle), while SCVPU (Small commercial vehicles and pick-ups) is starting to improve. The SCVPU market share will continue to improve.

- HCV grew by 5% YoY in FY24, while Passenger carriers grew by 26%. Passenger carriers improved by 38% YoY in Q4 FY24.

- Customer sentiment remained firm in the ILCV (Intermediate, Light Commercial Vehicles) segment in Q4 FY24 while marginally dropping for HCV Cargo and SCV (small commercial vehicle).

- In Q4 FY24, 26% of sales were generated through digital channels, with March 2024 being the highest-ever digital sales month. FY24 sales surged to 20.3% from 13.3% in FY23.

- The company announced ~140 new launches in this segment, with over 700 variants introduced during FY24.

- Ferrous metals experienced modest softening while barring aluminium and other non-ferrous metals stabilised.

- Cost optimisation efforts improve realisations.

- EBIT was at 9.6%, an increase of 100 bps YoY backed by better product mix and higher realisations. • Non-vehicle-business revenue grew by 13% YoY in Q4 FY24 and 17% in FY24.

- The company aims to boost profitability and market share by leveraging a superior product range, generating strong demand, growing downstream services, and scaling up value-added services. It also aims to maintain market shares, margins, and channel health in international markets, especially when TIVs (total industry volumes) remain low.

- On the EV front, the company has more than 4,300 Ace EVs on the road.

- Up to March 2024, 1,700+ EV buses were deployed, for a total of 2,600+ EV buses operational, including 1,150+ under CESL tender I, which includes Delhi Transport Corporation, Bengaluru Metropolitan Transport Corporation, and Jammu & Kashmir (J&K) Transport.

- J&K started e-bus deployment with 150 buses operationalised to date.

- TML e-bus fleet cumulatively crossed 140 million kms with over 95% uptime till Q4 FY24.

- E-dukaan, an online marketplace for spares, grew revenue by 3.8x over FY23.

- Fleetedge continues to build momentum, and 6,00,000 vehicles are currently on Fleet Edge. Subscription modules have been well received, and engagement times have improved further. Fastag integration completed in Fleetedge.

- Demand for CVs is expected to strengthen from H2 FY25 due to promising GDP growth, government incentives, and a focus on infrastructure.

- They remain cautiously optimistic about domestic demand while closely monitoring geopolitical developments, interest rates, fuel prices and inflation. However, they will continue to deliver strong EBITDA performance with a focus on net cash.

- The MHCV segment is expected to clock in strong growth going ahead.

TATA PASSENGER VEHICLES (PV)

- Q4 FY24 revenue stood at ₹14,431 crore, an expansion of 19.3% YoY. FY24 revenue was ₹52,353 crore, an increase of 9.4% YoY. PV volumes were 1,38,600 units in Q3 FY24, an expansion of 5% YoY supported by an intense supply situation, new SUV facelifts, and robust demand during the festive period.

- EBIT margins improved by 150 bps YoY to 2.9% owing to operating leverage on improved volumes and savings in commodity costs. FY24 margins were higher by 100 bps to 2%.

- In Q4 FY24, PV (ICE) EBITDA margins were 10.2%, an increase of 80 bps QoQ. The EV business was EBITDA positive (pre-R&D spending) at 1.1%.

- CNG (compressed natural gas) and EV penetration stood at 29% in FY24, with VAHAN’s market share improving to 14.3% in H2 FY24.

- PV volumes were 1,55,600 units, higher by ~15% Year over Year, supported by new SUV facelifts and multiple power trains.

- In FY24, Nexon sold the highest number of SUVs, while the Punch secured a position among India’s top 5 best-selling models.

- The EV volumes grew by 47.5% in FY24 to 73,800 units. The registration market share was 73.1% v/s 83.9% in FY23.

- The dealer network expanded to 293 across 192 cities.

- The charging network stations have increased to 10,065 units in FY24 compared to 5,314 in FY23.

- The launch of a new mid-sized SUV named Curvv, which will happen next month, would drive incremental volumes.

- For FY24, the powertrain mix is ~58% petrol, 13% diesel, 13% EV, and 16% CNG (compressed natural gas).

- They expect passenger car demand to remain strong. However, the high base effect and external factors like elections, heat waves, etc., may moderate the growth rate in Q1 FY25.

- The focus would be retail and delivering market-beating growth to sustain double-digit EBITDA margins and positive free cash flows for the PV business.

- It would continue proactively driving EV penetration through new product launches and ecosystem development and improving profitability.

TATA MOTORS FINANCE (TMF): Tata Motors Q4 Result:

- Collection Efficiency continues to improve with Q4 FY24 coming at 101.8% (v/s Q3 FY24 at 98.7%, Q2 FY24 at 97.3% & Q1 FY24 at 96.6%).

- GNPA (gross non-performing assets) decreased to 5.6% in FY24 from 8.3% in FY23. Early delinquency and roll-forward rates led to the decline.

- Sourcing and portfolio quality remain strong, and the focus on profitable growth will continue even in FY25.

- Q4 FY24 delivered disbursals of ₹5,588 crore against a full-year total of ₹17,884 crore.

- Disbursements for used vehicles and structured financing are being improved to support the future expansion of NIM (net interest margins).

- Capital adequacy is 20.9%, Tier-1 capital is 12.7%, and the Debt/equity ratio is 6.5x (down 6 bps YoY).

- Liquidity remained adequate at ₹4,900 crore.

UPDATES

- The plant which the company acquired from Ford (Sanand II facility) has commenced operations.

- The Punch EV has witnessed strong traction during the quarter.

- Harrier would witness growth in the next few quarters.

- They have received the PLI (production-linked incentive) license for Tiago EV and will receive the disbursements in H2 FY25. They will apply for additional products in Q1 FY25.

- The company would strategically pass on prices when the commodity inflation increases.

FUTURE OUTLOOK

- They remain cautiously optimistic about domestic demand over FY25 and expect H1 FY25 to be relatively weaker. The premium luxury segment’s market will remain resilient despite emerging concerns about overall demand. Despite this, they are confident of delivering a solid performance in FY25.

- In the future, they will intensify their efforts to grow market share profitably in every business segment by delivering more value to customers with innovative products, intelligent services, and holistic mobility solutions.

- The investment spending for Tata Motors Domestic Business was ₹8,300 crore, and similar expenditures are expected in FY25 as well.

3 thoughts on “Tata Motors Q4 Result FY-2024: Net Profit More Than Triples.”